Guaranteed Standard Issue Disability Insurance: What It Is and How to Get It

Many physicians with pre-existing conditions may be able to get covered for disability insurance. We'll explore what GSI disability insurance is, how it can benefit you, and how to get yourself covered.

Table of Contents

If you're reading this, you probably understand why disability insurance is an essential part of your overall financial well-being, as it offers protection in the event that you are unable to work due to an illness or injury. However, obtaining disability insurance can be a challenge for individuals with pre-existing medical conditions. This is where Guaranteed Standard Issue (GSI) disability insurance comes in.

We'll explore what GSI disability insurance is, how it can benefit you, and how to get yourself covered.

The impact of pre-existing conditions on Disability Insurance

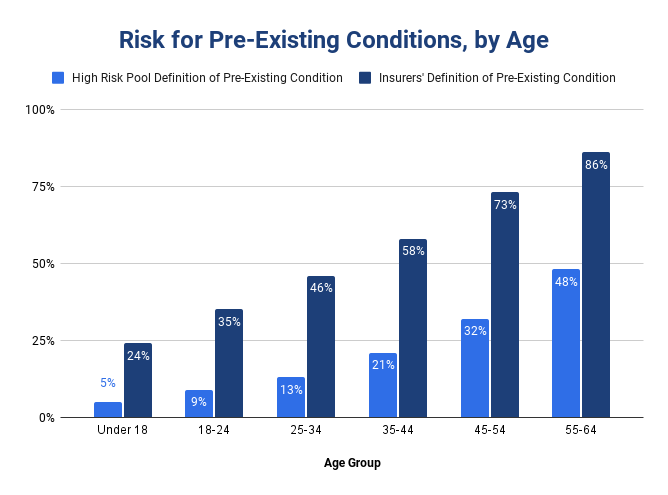

A pre-existing condition is any health issue, injury, or illness that an individual has before acquiring insurance coverage. Pre-existing conditions can be quite common: According to a 2019 study by the Department of Health and Human Services, approximately 27% of non-elderly Americans (ages 18-64) have pre-existing conditions, which amounts to about 54 million people.

To obtain a disability insurance policy, an applicant typically goes through medical underwriting, which is the process of evaluating an application for insurance coverage by examining the applicant's medical history. If a pre-existing condition is present, the applicant may be excluded from coverage for a certain period after the policy begins. During this time, the policy may not cover disabilities resulting from pre-existing conditions. In many instances, the insurance company may increase the price to cover for the increased risk of the pre-existing condition, or the application is declined, meaning the applicant is prevented from buying an individual disability insurance policy.

So what options does a resident or fellow with a pre-existing condition have? Applying for Guaranteed Standard Issue (GSI) disability insurance is one potential solution. GSI policies are offered by an insurance company to groups, such as residency or fellowship programs, and are typically only offered while you are employed with the group. One of the primary advantages of GSI Disability Insurance is its guaranteed acceptance. This means that as long as you meet the basic eligibility criteria, such as being actively employed and within a certain age range, you will be approved for coverage. This is especially beneficial for individuals who may have been denied coverage in the past due to their health conditions.

Understanding the Basics of GSI Disability Insurance

Guaranteed Standard Issue Disability Insurance, or GSI Disability Insurance, is gaining popularity for its unique benefits. GSI Disability Insurance is designed in the same fashion as traditional disability insurance, which is to provide financial support to physicians who are unable to work in their stated speciality due to a disability. Let's unpack the benefits:

📝 Minimal to no Medical Underwriting required: Unlike traditional disability insurance, GSI Disability Insurance does not require individuals to undergo a medical exam or provide a thorough medical history. This means that even those with pre-existing conditions can get coverage, making it an attractive option for many.

🧳 You keep the insurance even when you change employers: Even though GSI disability insurance policies are offered to groups, the insurance policy stays in your name, so you can take the benefits with you after you leave residency or fellowship. This means you lock in your rate and your insurability for the remainder of your working years, and won't have to re-apply for disability insurance if you switch jobs. This is a particularly important benefit, as most group-based disability insurance policies don't leave with you when you change employers. Getting disability coverage during residency also locks in your insurability for the remainder of your career.

💵 Can be a cheaper alternative than individual disability insurance: For certain individuals, Guaranteed Standard Issue (GSI) policies can offer a more cost-effective alternative to traditional disability insurance due to their group pricing structure. This can be particularly advantageous for demographics that typically face higher premiums, such as female applicants. However, it's essential to recognize that comparing GSI plans to traditional policies may not be straightforward, so it’s crucial to fully understand the trade-offs involved if you opt for a GSI policy based solely on pricing.

🏃🏻Faster application process: Residents and fellows are typically pressed for time, so the accelerated approval process of GSI disability insurance make it an attractive proposition for busy physicians during their training years.

🛒 Customization and flexibility: GSI disability insurance may offer the same benefit riders that are offered as part of an individually underwritten disability insurance policy, such as future income option (FIO) rider, own-occupation definition rider, and many other benefits that are critical for medical residents and fellows.

Are there any drawbacks of GSI Disability Insurance?

It's important to understand the drawbacks that come with GSI disability insurance compared to individual disability insurance. While these policies are have fast approval processes, applying for GSI disability insruance may come with some limitations.

🫰🏼 Can be more expensive: The premiums for GSI Disability Insurance tend to be higher compared to individually underwritten policies. The insurance companies take on the risk of insuring individuals without thoroughly assessing their health conditions, which results in higher premiums to compensate for the potential claims they may have to pay out. This means that the premiums can be slightly higher for individuals with no pre-existing conditions. Additionally, because these policies are issued at a unisex rate, the rates maybe more pricey for male applicants compared to applying for an individually underwritten disability insurance policy.

📈 Benefit limits may apply: Since there is no medical underwriting involved, the policy typically has a lower benefit amount compared to individually underwritten disability insurance policies. The majority of GSI disability insurance policies are capped at $20,000 per month, versus $30,000 per month for individually underwritten disability insurance policies. While this sounds like a huge payout during your residency and fellowship years, maxing out your disability insurance benefit in the event you cannot work in your line of specialty due to an illness or injury can be quite common for high-earning physicians.

🚩 You can only get it while employed by a group that can access GSI: Since GSI disability insurance policies are offered on behalf of insurance carriers to groups, you can miss out on obtaining coverage if you don't purchase it prior to leaving your residency or fellowship program.

How can you purchase Guaranteed Standard Issue Disability Insurance?

A disability insurance broker or advisor, can help you determine if your group is part of a GSI program and can help you complete an application. If your group is not participating in an existing GSI program, your advisor can set one up for your residency or fellowship program, as long as there are a sufficient number of other employees who would like to participate.

Guaranteed Standard Issue Disability Insurance provides peace of mind and financial security for individuals who might otherwise be left without coverage. It also enables potential cost savings, as well as an efficient process of approval which residents and fellows will appreciate.

ProtectMD Insights Newsletter

Join the newsletter to receive the latest updates in your inbox.